What Is A Period Cost Example

To quickly identify if a cost is a period cost or product cost ask the question is the cost directly or indirectly related to the production of products if the answer is no then the cost is a period cost. These are not incurred on the manufacturing process and therefore these cannot be assigned to cost goods manufactured.

Period costs do not relate steps in the manufacturing process.

What is a period cost example. Costs may be classified as product costs and period costs. A brief explanation of product costs and period costs is given below. Rather they are connected and measured in context of time.

A few good examples of period costs are advertising and administrative salaries. Example of period costs. On the other hand period cost are not a part of the manufacturing process and that is why the cost cannot be assigned to the products.

Therefore period costs are listed as an expense in the accounting period in which they occurred. The following illustrates costs incurred by a manufacturing company in the first year of operations. Product costs also known as inventoriable costs are those costs that are incurred to acquire or manufacture a product.

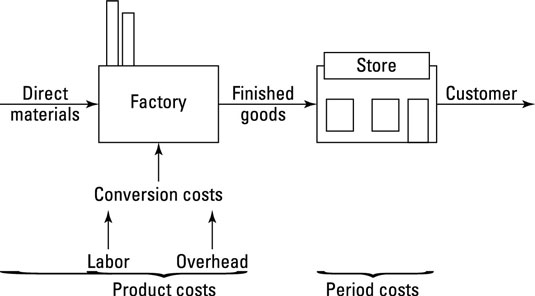

Period costs are not assigned to one particular product or the cost of inventory like product costs. The most important difference between product cost and period cost is that product cost is a part of cost of production cop because it can be attributable to the products. Product costs are costs necessary to manufacture a product while period costs are non manufacturing costs that are expensed within an accounting period.

This classification is usually used for financial accounting purposes. For example factory rent depreciation of machinery heating and lighting costs repairs etc. For a manufacturing.

A period cost is any cost that cannot be capitalized into prepaid expenses inventory or fixed assets a period cost is more closely associated with the passage of time than with a transactional event since a period cost is essentially always charged to expense at once it may more appropriately be called a period expense. Instead these expenses are attributed to selling and general administrative activities. A period cost is charged to expense in the period incurred.

As this is the cost to produce 1 000 tables the company has a per unit cost of 15 10 15 100 1 000 15 10. Example of period costs are advertising sales commissions office supplies office depreciation legal and research and development costs. Period costs or non inventoriable costs or non manufacturing overheads are all such costs that are not incurred in connection to the production.

Period costs are thus expensed in the period in which they are incurred. The two main function groups are period costs and product costs. Example of the period cost is office rent office depreciation which is capitalized over the years of the asset indirect labor which is not directly related to the production of goods.

Examples of product costs are direct labor inventory raw material manufacturing supplies etc.

Exam 1 Chapters 1 3 Key Pdf Free Download

Quiz Worksheet Period Costs In Accounting Study Com

Cost Classifications On Goods Inventory Statements Video

Inventoriable And Period Costs Definition With Example And

Period Costs What Small Businesses Need To Know The Blueprint

Period Cost Examples Top 4 Examples Of Period Cost With Explanation

Contract Period Details Example Documentation For Cost Analyzer

What Is Product Costs And Period Costs Qs Study

Erp Resources Three Types Of Cost Adjustments In Opm Financials

What Is Total Manufacturing Cost Definition Meaning Example

Product Costs And Period Costs Youtube

Answered Distinguish Between Product Costs And Bartleby

Managerial Accounting Concepts And Principles Ppt Download

Solved 55 Mcq Which One Of The Following Is An Example Of A

Managerial Accounting And Cost Concepts

Product Cost Versus Period Cost

Product Costs And Period Costs Explanation And Examples

Download 55 Mcq Which One Of The Following Is An Example Of A

Period Costs Definition Example Impact On Income Statement

02 Questions And Answers U Of G Studocu

Acc406 Wk 2 Ch 2 Exercise 12 Ryerson Studocu

Solved 7 Each Of The Following Would Be A Period Cost Ex

The Difference Between Product And Period Costs Dummies

C Ghanendra Fago M Phil Mba 1 Income Recognition And Reporting

Solved S For A Manufacturing Company Which Of The Follo

Managerial Accounting Canadian Canadian 10th Edition Garrison Test

Period Cost Vs Product Cost 7 Most Valuable Differences To Learn

Manufacturing And Non Manufacturing Costs Online Accounting

Period Costs Or Noninventoriable Costs Or Non Manufacturing

Managerial Accounting Concepts And Principles Ppt Download

Chapter 2 Cost Terms Concepts And Classifications Introduction

Solved Question 25 An Example Of A Period Cost Is Fire I

Cost Terminology And Concepts Basic Cost Terminology Cost

Doc Product Costs And Period Costs Kabbo Ahmed Rahat Academia Edu

Test Bank For Introduction To Managerial Accounting Canadian 5th

Accounting Ii Chapter 18 Powerpoint

Posting Komentar

Posting Komentar