On A Bank Reconciliation Deposits In Transit Are

In a bank reconciliation the total amount of outstanding checks needs to be deducted from the balance per bank books. For may 31 is as follows.

Bank Reconciliation Formula Examples With Excel Template

Outstanding checks these are checks that have been written by the company but have not yet cleared the bank.

On a bank reconciliation deposits in transit are. Deposits in transit must be added to the bank side of the reconciliation because they have been added to the book side when the deposits were recorded by the company. The bank service charge is 50. Deposits in transit are deposits the business knows are in route to the financial institution but are not yet processed by the bank.

They need to be added to the bank s balance in the bank reconciliation process. Deposits in transit are a major part of bank reconciliations in which an accountant completes a monthly reconciliation of the cash figure on the company s balance sheet to the bank balance. When a check is written it takes a few days to clear.

Outstanding checks amounted to 465. Deposits in transit are 655. In a bank reconciliation deposits in transit need to be added to the balance per bank books.

Bank reconciliation information for kaden co. Deposits in transit also known as outstanding deposits are those deposits that are not reflected in the bank statement on the reconciliation date due to the time lag between when a company deposits cash or cheque in its account and when the bank credits it. Click again to see term tap again to see term.

Deduct any outstanding checks. From the bank reconciliation no entry was recorded for deposits in transit. A bank service charge will require a to the general ledger account cash.

Since the company records the increase in bank balance in its accounting records as soon as the cash or cheque is deposited the balance as per bank statement would be lower than the balance as. Using the cash balance shown on the bank statement add back any deposits in transit. This would cause no impact since deposits in transit are already included in the balance per books.

The bank statement balance is 2 936. The essential process flow for a bank reconciliation is to start with the bank s ending cash balance add to it any deposits in transit from the company to the bank subtract any checks that have not yet cleared the bank and either add or deduct any other items. A check for 97 for supplies was recorded as 79 in the ledger.

The cash account balance is 3 194. On the bank statement compare the company s list of issued checks and deposits to the checks shown on the statement to identify uncleared checks and deposits in transit.

7 Accounting For Cash 7 Accounting For Cash Cash Includes

Bank Reconciliation Explanation Accountingcoach

Solved On A Bank Reconciliation Deposits In Transit Are

How To Prepare A Bank Reconciliation 8 Steps With Pictures

Bank Reconciliation Principlesofaccounting Com

Bank Reconciliation Formula Examples With Excel Template

How To Prepare A Bank Reconciliation 8 Steps With Pictures

Bank Reconciliation And Entries Beeler Furniture Company Deposits

Bank Reconciliation Examples Brandongaille Com

Solved Required Information The Following Information Ap

Solved 12 On A Bank Reconciliation Deposits In Transit

Bank Reconciliation Principlesofaccounting Com

Bank Reconciliation Definition Example Of Bank Reconciliation

Cash Bank Reconciliations Accounting In Focus

How To Prepare A Bank Reconciliation 8 Steps With Pictures

Using The Following Information Prepare A Bank Reconciliation For

Solved Required Information The Following Information App

Cash In Bank Bookkeeping Simplified

Financial Accounting Fifth Edition Ppt Download

Solved Tony Company S Bank Reconciliation At The End Of J

Define The Purpose Of A Bank Reconciliation And Prepare A Bank

Solved 1 Identify And List The Deposits In Transit At Th

Cash Bank Reconciliations Accounting In Focus

Solved 1 Identify And List The Deposits In Transit At Th

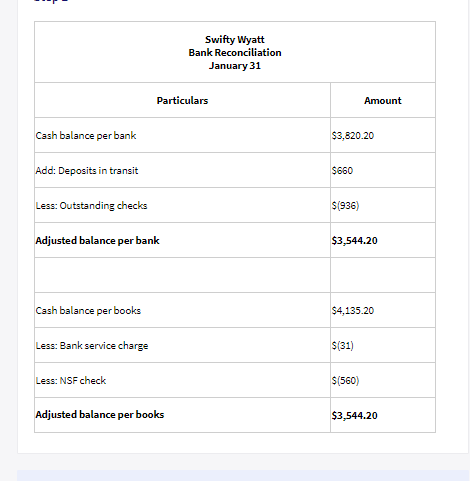

Answered Swifty Wyatt Bank Reconciliation Bartleby

Bank Reconciliation On July 31 Sullivan Company S Cash In Bank

Deposits In Transit What Are Deposits In Transit Youtube

Bank Reconciliation Statement Calculating Deposits Intransit

How To Prepare A Bank Reconciliation 8 Steps With Pictures

Answered The Following Data Were Accumulated For Bartleby

Solved 17 When Preparing A Bank Reconciliation Deposits

Any Data You Can Use B Prepare A Bank Reconciliation Statement

Define The Purpose Of A Bank Reconciliation And Prepare A Bank

The Seven Deadly Sins Controls Over Cash Handling Part 2

Bank Reconciliation Principlesofaccounting Com

Cash Bank Reconciliations Accounting In Focus

Posting Komentar

Posting Komentar