Third Party Sick Pay

Third party sick pay is reported on form 8922 third party sick pay recap if the liability for the employer s portion of fica taxes has been transferred between the employer and the employer s third party. Sick pay includes both short term and long term benefits often expressed as a percentage of the employee s regular wages.

Third Party Sick Pay Carpenters Combined Funds

Taxing of third party sick pay payments.

Third party sick pay. Your third party sick pay is taxable. This is due to the fact that sick payments are made in place of regular wages. Fica taxes however apply to such payments only for the first six months.

Whether the third party or the employer reports the sick pay on form 8922 depends on the entity that is filing forms w 2 reporting the sick pay paid to individual employees. Most employers provide some degree of wage protection for employees who miss work due to personal illness or injury. Third party sick pay your employees may receive sick pay during a temporary absence from work due to injury sickness or disability.

Third party sick pay and federal employment taxes. If sick leave is received more than six months after work is discontinued it s classified as unearned income. Third party sick pay is sick pay that is paid to an employee by some person the third party other than the employer for whom services are normally performed.

Third party sick pay is considered earned income if the individual receives it within six months after leaving work from an incident. This agent has no direct insurance risk and is simply acting as a type of administrative service. Third party sick pay 3psp is a disability insurance benefit that provides employees with partial or full wage benefit payments while on long term medical leave.

The payments are not made through the employer but through an insurance company union plan or a state temporary disability plan. If the employer pays the entire insurance premium then the sick pay payments received are 100 taxable to the employee. Do i need to withhold minnesota income tax on third party sick pay.

Third party sick pay via employer s agent as defined by the irs a third party may act as the employer s agent sometimes called a third party administrator. Sections 3121 a and 3306 b of the internal revenue code code provide. If the employer pays a portion of the premium and the employee pays the balance with after tax dollars then the sick.

If your employer paid for the policy. If the employer. Sick pay paid directly by an employer generally is treated as ordinary wages subject to withholding for federal employment taxes.

You ll receive a w 2 with taxable wages in box 1 and include this w 2 in your return.

Https Cs Thomsonreuters Com Ua Acct Pr Csa Cs Us En Pdfs Csa 3rd Party Sick Pay Procedure Pdf

Https Support Na Sage Com Selfservice Viewattachment Do Attachid Thirdpartysickpay Pdf Documentid 19284

Weekly Challenge Question 20191203 Do You Know The Answer

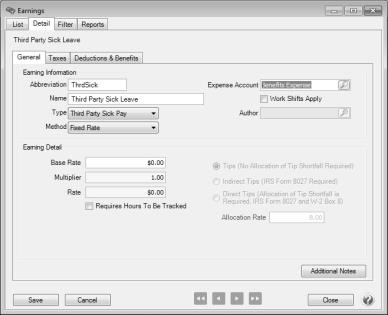

Procedures For Handling Third Party Sick Pay In Payroll Cs Or

Fillable Online 2019 Form 8922 Third Party Sick Pay Recap Fax

How To Report Third Party Sick Pay In Checkmark Payroll

Publication 926 2020 Household Employer S Tax Guide Internal

Recording Third Party Disability Insurance Payment Tdi Paid By An I

Online Third Party Sick Pay Form Fill Online Printable

What Forms Do I Use To Print W2s 1095s And 1099s

Http Www Sage Com Na Media Site Sage Payroll Services Pdf Ye Sick Pay Form

How To Account For Third Party Sick Pay On W 2 And 941 Tax Forms

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcqepdd 9 Ao9 Olqbbaqbar3xovmoxoxxk9czwqedgpdrgliume Usqp Cau

Ashley Explains Third Party Sick Pay Video

Fixed Indemnity Sick Pay Taxable In Cafeteria Plans Irs Memo

Mpay Software Knowledge Base Article

Third Party Sick Pay By Jamesrichard Issuu

Http Www Edd Ca Gov Pdf Pub Ctr De231r Pdf

Sage 50 Third Party Sick Pay W2 Entry Recording 800 301 4813

Usps Calendar Year End Review Ppt Download

Everything You Need To Know About Third Party Sick Pay Workest

Understanding Third Party Sick Pay Genesis Hr Solutions

Third Party Sick Pay Reporting Faqs American Fidelity

Irs Form 8922 Download Fillable Pdf Or Fill Online Third Party

What Is Form W 2 An Employer S Guide To The W 2 Tax Form Gusto

Everything You Need To Know About Third Party Sick Pay Workest

Https Cs Thomsonreuters Com Ua Acct Pr Csa Cs Us En Pdfs Csa 3rd Party Sick Pay Procedure Pdf

Section H Part 2 Special Items For Adp Tax Filing Recording

Centerpoint Payroll Third Party Disability Sick Payments

2019 Instructions For Schedule H 2019 Internal Revenue Service

Https Www Paycor Com Media W1siziisijiwmtavmtavmjevsmfudwfyev9dueffq2fyzv9ozxdzbgv0dgvylnbkzijdxq

Https Support Na Sage Com Selfservice Viewattachment Do Attachid Thirdpartysickpay Pdf Documentid 19284

Https Www Gadoe Org Technology Services Pcgenesis Documents D3 W2statementproc 2 4 Pdf

Section H Part 2 Special Items For Adp Tax Filing Recording

Posting Komentar

Posting Komentar